Strategy

Company profile

PolyPeptide is a globally active contract development and manufacturing organization (CDMO) specializing in the manufacturing of peptides used as the active pharmaceutical ingredient (API) in therapeutic products. It also produces a range of peptides used in cosmetics. The Group mainly serves pharmaceutical and biotech companies as well as academic institutions.

The Group’s history dates back to 1952, when it began the commercial manufacturing of therapeutic peptides in Malmö, Sweden. Since then, it has manufactured over 1,000 GMP peptides and has developed into a full-service provider with differentiated technologies and capabilities to manufacture the most complex and innovative peptides. Through its network of six Good Manufacturing Practice (GMP)-certified sites in Europe, the US and India, it offers products and services along the entire peptide API value chain, including comprehensive analytical and regulatory support. Its activities cover the full life cycle of the customers product, from early pre-GMP development to phases I to III of clinical development up to product approval and commercial production for originators and generic suppliers. In the United States the offering also includes neoantigen peptides to support personalized cancer therapies. Following efforts initiated in 2019, the Group in 2021 added oligonucleotides to its offering given the increasing relevance and substantial R&D investments in this therapeutic modality.

For further details on the footprint and the business model of the company, please refer to the chapter Profile.

Market position

According to a market study commissioned by PolyPeptide and completed in early 2021 (the Study), the peptide therapeutics market is estimated to grow with a compound annual growth rate of 7% over five years reaching approximately USD 44 billion by 2025, driven by, among others, the increasing number of expected approvals of new peptide-based therapies and the growth of underlying patient populations. Therapeutic areas continue to broaden and include metabolic disorders, oncology, infectious diseases, orphan diseases, cardiovascular, neurology or gastro-enterology applications. As of the end of 2021, circa 81 peptide-based therapies were approved by the US Food and Drug Administration (FDA), with approximately 250 in clinical development (phases I to III) and around 500 in pre-clinical development.

According to the Study, the peptide API market is estimated to represent 5% to 8% of the peptide therapeutics market, of which around 65% is outsourced. With the continued outsourcing of peptide API development and manufacturing to specialized CDMO’s, the outsourced peptide API market addressable by PolyPeptide is expected to grow by approximately 10% per annum to USD 1.9 billion by 2025. Based on available market data for 2020, the estimated market share of PolyPeptide was between 20% and 25%, leaving the company placed as a market leader, second to its main competitor.

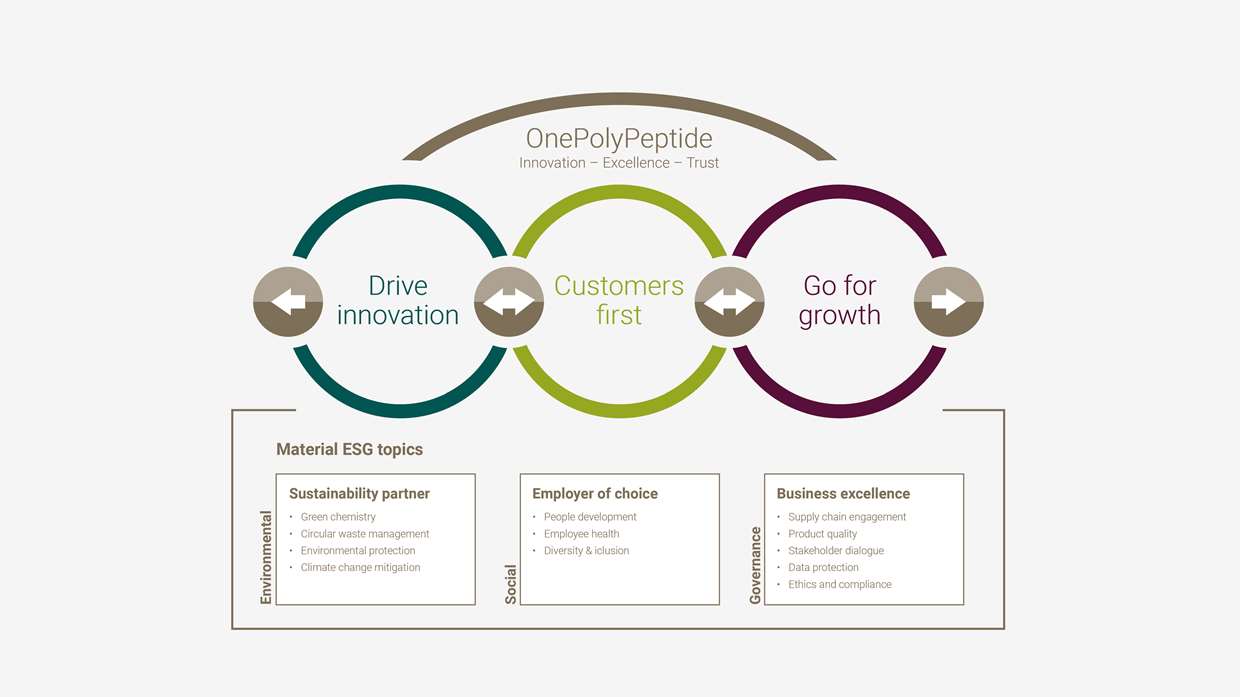

Integrated strategy

The Group’s mission is to help customers secure regulatory approvals and to successfully launch and commercialize their products in the market, while being flexible to adapt to the inherent uncertainties of drug development.

Building on its core values of “innovation”, “excellence” and “trust”, PolyPeptide aims to be the preferred long-term partner for all its customers, who typically expect deep operational experience and scientific knowledge, coupled with a relentless focus on quality and a high delivery performance. As a multinational company with around 1,100 engaged and experienced employees at the end of 2021, PolyPeptide also emphasizes an agile, open and collaborative work environment.

The integrated strategy of the Group is articulated around four priorities:

- Customers first: The Group strives to maintain a high level of customer satisfaction across all relevant dimensions, including scientific expertise, product delivery, customer service, quality, project management and execution. It serves a growing number of customers and continuously invests in its infrastructure, its processes and workforce to meet customer expectations.

- Drive innovation: The value generation of the Group is closely linked to its leading-edge capabilities in providing its products and services effectively, efficiently, and responsibly. To that end it maintains a holistic innovation agenda to ensure its manufacturing and analytical capabilities stay at the forefront of technology. In particular, the Group collaborates actively with various universities, start-up companies and scientific institutions to access innovative technologies. An important element is the Group’s ambition to implement green chemistry processes to reduce the environmental impact from manufacturing activities.

- Go for growth: PolyPeptide aims to continuously build its high-quality API development projects pipeline and to serve its customers throughout the lifecycle of their products. Given the strength of its late-stage development pipeline, the Group is substantially increasing its capital expenditures to meet expected growth. Upcoming patent expiries provide opportunities to further develop the peptide generics API business. With the decision to enter the emerging market for oligonucleotide-based API’s, the Group aims to address unmet needs of customers, thus unlocking an additional avenue of growth.

- Collaborate as “OnePolyPeptide”: The Group maintains a program to continuously optimize internal collaboration, seeking the right balance between local entrepreneurship and global coordination. PolyPeptide seeks to reinforce, continuously improve, and harmonize processes, systems and platforms across the Group, including for example digitalization, automation, cyber security, talent management, vendor qualification, risk management, and quality systems.

Recognizing the importance of environmental, social and governance (ESG) criteria as part of the daily business conduct, PolyPeptide adheres to fundamental principles of business ethics, corporate responsibility, and compliance. In 2021 it conducted an ESG materiality assessment to formalize earlier efforts and to define its ESG agenda (see chapter Corporate Responsibility).

Twelve material ESG topics were identified and will be managed as part of PolyPeptide’s strategy. The Group thereby pursues a holistic approach to sustainability that includes reducing its environmental footprint, promoting continued improvement towards business excellence as well as strengthening the company as an employer of choice. The Group believes that the integration of the twelve material ESG topics into its strategy is the most effective way to meet both business needs and stakeholder expectations. In particular, the material ESG topics of green chemistry, people development and supply chain engagement are seen in the current development phase of the company as customer value enhancing and differentiating opportunities, building on the partnership-based culture of the Group.

PolyPeptide’s integrated strategy

Scorecard and financial aspiration

The Group maintains a global balanced scorecard for supporting the implementation of its strategic agenda and for executive compensation purpose (see Remuneration

Report). Besides the financial targets for revenue and adjusted EBITDA for a given period, the balanced scorecard includes quantitative goals for non-financial criteria. They are annually assessed by the Board of Directors and include “on time in full” (OTIF) delivery performance, quality, employee retention, Environment Health & Safety (EHS), customer feedback, innovation initiatives and critical project execution.

PolyPeptide’s sales growth in 2021 reached 26.5% and includes a favorable impact related to customer projects in response to the coronavirus pandemic. The Group communicated a medium-term aspiration to grow revenue with a “low teens” percentage increase versus the prior year and with an adjusted EBITDA margin of around 30%. It is currently in the process of updating its long-term strategic plan and will update its financial aspiration as appropriate. While prioritizing organic growth, PolyPeptide is open to opportunistic acquisitions, potentially to expand capacity, to broaden its geographic reach or to further strengthen its technological capabilities.

The company’s goal is to provide a stable dividend to its shareholders, representing a pay-out ratio of between 20% and 30% of the Group’s result for the year.

For the financial outlook for 2022, please refer to the Editorial and the Business Review.